Tuesday, August 26, 2008

Back From The Dead

Nonetheless, I've had a long losing streak in which, at times, I've been completely without direction. It's not so much about the money lost. That happens. It's the fact that I have invested myself completely into this over a number of years, both financially and emotionally. Trading is it for me. Then to feel like you're failing. Well let's just say it's sobering.

So I felt sorry for myself all night Friday and all day Saturday. Didn't look at a chart until Sunday afternoon. By Sunday night I realized that I have a long track record to look back at for some perspective. I've been trading again for 63 months. I've had months much worse than this one and I have always bounced back. This time will be no different.

So what happened today? I was proven dead right. The selling I did Friday rewarded me today. It was truly a monster day. Not only that, but it appears increasingly likely that I am well positioned for the upcoming move.

So after all my mistakes and self-flagellation here I sit. Still at the table.

Friday, August 22, 2008

Whew!

I'll admit, I was a touch surprised by the strength this morning but it's exactly what I want to see. This is typical of a retrace to a broken trend line. Same thing with oil yesterday, retraced in a straight line.

So with the market up over 12,600, I started selling. Have a handful of shorts touching the underside of their trend lines which I have added to. Started buying back my inverse ETFs. SKF I will scale back into a hundred shares at a time.

I was down at one point almost 2.5%. Now just down a touch. If I am correct in concluding that the advance has ended, I'm going to look like a genius. If not, I will retreat again.

Thursday, August 21, 2008

Going Higher, For the Moment

My target for the S&P is 1285. If we make a run at the broken trend line off the lows we are looking at 1295 or so. For the time being anyway I'm waiting for 1285-ish before I consider getting aggressively short once more.

Tuesday, August 19, 2008

RISK!

My general mind frame in the market is that anything can happen and you will often be wrong. At the same time, I want to get paid when I'm right. Don't feel as if I capitalize on winning ideas to the degree I should in order to maximize my returns. The whole idea is to maximize profit and minimize loss. I feel confident in my ability to do the latter but not the former. So in a situation like this, where I have a high probability of success, I will press my bets, i.e. take more risk.

Let me put it this way: if we go lower, say re-test the lows, I will get paid. I will materially improve my situation.

So here is the challenge. I have to stay put and wait. Not so easy. It's a big and growing position and I tend to have happy feet. I have to submit to the volatility inherent in a bet of this size. If I entered at the right time my position will not be threatened by a pullback. If not, I'm wrong and I admit it. Limit losses, period.

My time frame has gotten shorter, and churn higher, lately due to a number of factors. Choppiness of recent market action (i.e. failed breakouts, of which there are many) and more time spent in front of the laptop in the summer, to name two. Looking to play the big swing here in the longer time frame.

All the time I am closer to taking my trading to the next level. Now with better tools, I'm tweaking and improving my trade all the time. The whole idea is to stay at the table or in the game until you get your chance to win big. But win big you must.

My biggest fear is the next bullshit bailout. Paulson and that other asshole, Bernanke. Better come up with some coherent plan fellas, Fannie and Freddie are going to zero pretty quick. The list of financials circling the bowl is lengthy. In totality, it's too big to bail but I'm sure the stunts will continue.

Bearish Again; It Feels So Good

Financials will lead the market lower again. Commercial real estate is about to get smashed. Recently I had been seeing a lot of breakouts and potential breakouts, now I see failed breakouts and resistance. I remember feeling the same way last time commercial RE shares topped out. This time though I mistakenly bought some of the failed breakouts.

Nothing, rather not much, has worked for me recently but I feel very confident betting against the market here. Refiner trade didn't work. AMLN didn't work. HSY didn't work. That's what happens when you get too cute. The market charges tuition fees.

I realize that there is a degree of the 'get it all back' mindset, following losses, but I really want to press my bets.

Monday, August 18, 2008

Rut-Roh!

Thursday, August 14, 2008

I Am Never Going On Vacation Again

This is all very upsetting. I am emotionally and psychologically tied to winning and losing. I win and life is pretty good. I lose and life is downright depressing. This in itself is a problem.

To be honest, I am shell shocked. I am the proverbial deer in the headlights. Today I actually just froze up and couldn't act. It's enough to make you want to quit.

I have been here before. I will pick up the pieces and slowly plot my comeback. I have worked way too hard to give up. It's not in my nature to quit. My losses are very manageable, small compared to other losing streaks. I will scrape my way back and I will have my revenge. I assure you.

Testing Support Again

Wednesday, August 13, 2008

Ready to Nibble

Tuesday, August 12, 2008

Scratch That

No surprise that I found a number of names worth shorting today. I've balanced out my remaining longs after jettisoning the few that stopped me out. Stopped out of TOL and SLG. So much for my long real estate trade. That's alright, it never felt right.

Also stopped out of VLO. The refiners trade like shit.

As for shorts, aside from WB and LEH, some highlights include BA, NKE and IBM. Hope springs eternal. Came into the day short SYT and FRO and those worked pretty well. MON, on the other hand, stuck it to me.

Intraday I got long some FRP for a quick profit. Seems like I continue to do to just enough right to keep from getting a real job. Barely. Honestly this is the hardest market I've ever seen. Period. The whole key is to cut your losers. No time for hesitation.

I'm not entirely convinced that the bulls are done. We'll find out soon enough. Watch the BKX to find out. It's been fun to have some longs for a change but I will not hesitate to go back on the attack and start selling again.

It's Tuesday, Let's Sell

Shorted a couple of the walking dead financials, WB and LEH. They look to be some of the first to rollover.

The key to being long here is to not to get too aggressive. All of this volatility is, in my mind, a sign of instability. I certainly don't want to be leaning too far in either direction.

Monday, August 11, 2008

Another Bottom?

Monday Monday

A lot of traders are targeting 1320 on the S&P which happens to be the 50% retrace. I think we could go even higher and maybe make a run at the downtrend line coming off the top. Depending on how long it takes us to get there we could see 1350-1375.

The big news ofcourse is the Russia-Georgia conflict. It's not doing much for oil this morning, or gold for that matter which continues to work it's way lower. I love how Bush tries to act all hard saying he has been firm with Putin. If I was Putin I'd tell 'ol George to go pound some dirt and I'm sure he did, in diplomatic terms. The ultimate risk, now that the oil pipeline has already been bombed, is a scenario in which NATO gets involved on the side of Georgia. That would not be good, to say the least. Also, this conflict puts Europe's natty gas supply at risk. This is a fragile situation to say the least.

The market is working higher this morning, which I expect. My shorts are mixed. I think there is downside in Ag. The last thing I did Friday was to short MON. Haven't done too much this morning. Bought some HSY and I'm up a quick buck. Took some profits as well in ITW and RAVN, perhaps that was a bit hasty but it is what it is.

Friday, August 8, 2008

Boostin' Loose

I've been a buyer today. Bought the TOL breakout (even though it makes me sick) and caught VLO breaking out of a triangle. Been a (short) seller too, of SSRI.

Watching the refiners closely. They've been destroyed with the rise in crude. With crude breaking down I'm looking for the bounce. I'm going to be a big buyer of TSO above $18, started nibbling this afternoon (perhaps prematurely).

Most exciting though, is that amidst all this strength I've managed to hold on to three of the four shorts I started the day with. Still short FRO (happily), PX (giving it some rope) and GIFI which is down a buck at the moment. I swear to God GIFI is something else, it seems to trade contrary to reality. The market gets killed (like yesterday) and it's strong and vice versa today.

Today's disappointment was ALCO. Waiting for the breakout but forgot to check it until about a half hour into the day. When I did it was up a buck and a half. Damn missed it, or so I thought. Later on in the afternoon it was up Five. FIVE! Wow.

The market can go ahead and close now. I'm pleased. Had a very, very nice day. Everything seemed to work.

Oil is Broken

The stock market is happy and, for a change, I'm happy by extension. Since last August almost every time we have had one of these giant rallies I have been cursing and breaking things. Today I am long. I enjoy the novelty of partaking in the bulls' joy but I remain a bear in bull costume. Higher prices will eventually lead to me shedding my costume and going all Rambo on these bulls.

I think we're making another run at 1292 on the S&P and I expect a breakout but let's not get too far ahead of ourselves.

Thursday, August 7, 2008

One of These Days...

Funny thing about today: I break my rule of no daytrading (out of frustration) and buy 1000 DXD (2x short Dow). It's plainly obvious that the market is going over the cliff. So after the initial break of the lows I initiate the position and literally four minutes before the market goes into a waterfall I sell it! For no gain! HA! Fucking hilarious!

I'm leaving now to go punch myself in the face. Have a nice fucking day.

My Bad

We have rallied off the lows this morning but it still feels like we are heading lower this afternoon. Truly this market has no direction here. This is consolidation.

Wednesday, August 6, 2008

Making Money Long (Well, Hopefully)

Got long RIMM, UAUA, MCHP, RTN and ITW, all of which are breaking out. Also shorted some GIFI off of a head and shoulders top.

Line in the Sand

Above it I get short term bullish (gasp!). Failure to surmont that level and it won't be long before I resume my selling. Leaning towards the former but it's just a hunch.

Tuesday, August 5, 2008

Piss Poor

Some combination of lack of conviction and poor attention during trading hours has me grounded. Grounded as in right into the fuckin' dirt. My lack of conviction, I believe, has something to do with coming back from vacation feeling out of the loop and lack of clear direction in the market as a whole. Poor attention during market hours is the harder part for me to deal with. I look at today's watch list and the winning trades are all right there on paper written by my hand. So I guess I just need to get my head on straight before I find myself living in a cardboard box.

This is the hard part of trading, the part that you can't teach. Psychology. It's the key to the whole puzzle. My tools and strategies are simple but trading itself is extremely challenging.

The only thing I can fall back on is that I've been here before. Many, many times. Time to pick myself up out of the dirt, brush myself off and get back to my winning ways. I have no doubt that I will be successful in the long run but it's easy to lose sight of the big picture when faced with adversity.

Monday, August 4, 2008

Nowhere to Hide

The general consensus is that commodities getting bludgeoned should be bullish for everything else. I'm not so sure about that. Rather I think the pain has just increased. Previously we were pricing in an elevated chance of outright implosion in the financials, which became less pronounced once Bernanke and Paulson decided to try and bail out their buddies, now we are pricing in a recession. Enjoy.

Putting Dogma Aside

That's ugly. Also problematic is the chart of my old friend PAAS. I've made a small fortune being long this stock over the years but now I want to be on the other side of that trade. At least for the time being.

You know, the market is funny and often operates contrary to your expectations. I'm somewhat surprised the metals aren't going nuts to the upside considering the backdrop. However, I trade based on reality not dogma. Best case scenario is that the metals get hammered and set up the buying opportunity of a lifetime. We'll see.

Yes I did short PAAS this morning.

Sunday, August 3, 2008

Sunday Offering

Isn't that one beautiful head and shoulders top? Wouldn't be surprised to see this index trade below 400. You may now be wondering how it is you might play a top in the utilities index, if so shame on you because you weren't paying attention last week when I told you.

After doing some homework in anticipation of a top in the Utes I came across SDP. Immediately I knew that this new found symbol would come in handy down the road and sure enough one week later it's showtime. The important thing though is waiting for the pattern to confirm. Timing is key. In this case the pattern will complete with a decisive break below the neckline, say 470. I'll be looking for that Monday to get long SDP.

Let's Review My Brilliance

Good for twenty plus points. Damn I'm (occasionally) good!

Saturday, August 2, 2008

Saturday Workday

Around 3:30 I had a small bowl of beans and rice.

Next I went and ran 4 miles in the blazing hot sun. Took a quick dip in the pool, before finishing up with some weightlifting.

This is how I will defeat my opponents. I will outwork them.

Friday, August 1, 2008

Off to the Beach

Have just a couple of nice gains and a bunch of small losses to show for my time this week. I can find better things to do, which is why I'm outta here. Have a nice weekend.

Thursday, July 31, 2008

Good Riddance

It occurred to me last night that getting long here is bit too cute which is why I took some longs off the table first thing this morning.

Honestly, I couldn't be happier now that July is over. It's been a month of distractions (vacation) and whipsaws (everywhere). In the end the market was flat for the month. Maybe now we can find some direction.

After trading like a god for about six weeks the last couple, since returning from vacation, have been tough yet I've not sustained major losses. Therein lies the key: limit your damage when things aren't going well. I feel more confident than ever that my next big hit is just over the horizon, which is important because it keeps me from pulling out my hair after a month like this

Limping Home

Also sold LLL too quick before it ramped another buck. As much as I try to hold my winners sometimes I lack the discipline to do so. What is there to say? I love to take profits and in the current market environment gains vanish quickly.

July has been a roller coaster. Up huge until this week when I got hammered, I'm now limping toward the finish line. The (somewhat premature) final result: I win again (in unspectacular fashion). Fine. I'm just hanging in until I get that fat pitch right down the middle.

UPDATE: MOT up 13%.

Wednesday, July 30, 2008

Got Drunk, Bought Stocks

With that bit of business out of the way I proceeded to go on a drunken buying binge like some coked up money manager. Regardless of how it works out I feel pretty good about having covered most all of my shorts yesterday. Today would be painful had I tried to justify my positions rather than just reacting to the market's verdict.

As a trader you are going to be wrong about half the time. The whole key is to admit it quickly and cut your losers.

Fresh and Clean

The erroneous theory, I gather, is that Merrill's huge write off, fundraising and sale of toxic assets marks the bottom. Never mind that the toxic paper sale was 75% financed by Merrill themselves and that two weeks ago they claimed not to need capital (was that a bald faced lie? and where the fuck is the SEC on this?). But now the market can function again and other impaired institutions can follow Merrill's lead. Divest, write off, nirvana. Or so the theory goes.

I agree that it's a step in the process. But I ask you this: who the hell is going to buy all this bad paper? There is so much of it everywhere. Besides if Merrill said this paper was worth 40 cents on the dollar two weeks ago and now they sell it for 20 cents on the dollar, what does that tell you about the balance sheets of other financial institutions? Pure fiction.

The psychology is such that bulls believe every disaster to be the bottom. Ultimately I expect us to go much lower on the averages but not in a straight line. We are due for a rally, before another fall. So again I'm rooting for a good old fashioned drunken rally where money mangers can do a few lines and buy stocks with reckless abandon. If nothing else I hope it might relieve this white knuckle feeling we've had lately.

Either way, rally or no, I will capitalize. I will trade long or short. I will cut my losers without hesitation. I will continue to learn and ultimately dominate. Put that in your pipe and smoke it.

Tuesday, July 29, 2008

Pain

Today's action explains my hesitancy to pull the trigger. Up 200, down 200- fuck that.

So having officially capitulated, I am now net long. It sucks but what are you going to do? If I have to get long to make money I will do that. Roll with the punches and live to fight another day. Easy come, easy go. Yada yada yada.

Financials in the green and oil in the red is a powerful potion for higher stock prices. I still think we could see another 600 points of upside on the Dow. I might even get long some beaten down financials just for shits and giggles.

Monday, July 28, 2008

Taking Advantage of a Bad Situation

These actions are unprecedented. We have opened a new chapter in American history. This is the era of crony capitalism.

I expect interest rates to ramp up over time. I've done some research and found some ideas to take advantage of this nascent trend. Put SDP, PST and TBT on your watchlist. I have taken no action as of yet but these will be on my radar. When treasuries weaken you want to own PST and TBT. As a result, interest rates go higher which is quite bad for utilities and that's where SDP comes in.

Well Said

"Unfortunately, the laws of capitalism are now demanding that home prices continue to fall precipitously. But, based on the speed in which our government, public and financial institutions are willing to abandon free market principals at the first whiff of economic pain, the likelihood that this impulse will take hold is increasingly remote. So hunker down as the United States finds itself on the express track to state socialism with Paulson’s Bazooka locked, loaded and pointed right at us. When the government pulls the trigger the blast will blow the dollar, and what’s left of our capitalist economy, to smithereens."

Back to Swimming with the Sharks

Got stopped out of PFE. Getting long; what the hell was I thinking?

As for today, it sucked. The market is down a solid two percent and I'm up only one despite starting the day net short. I consider that under performance. There are an abundance of opportunities out there but from time to time I'm hesitant to pull the trigger. Now is one of those times.

The market's lack of enthusiasm for the latest bailout (that of Fannie and Freddie) is an ominous sign indeed. If the bailouts stop working the gates of hell will yawn wide. Bet on it.

Today I got short a few more names: COF, GGP and STT. Those moves accounted for better than half my gains. As I've stated repeatedly as long as the financials remain broken the market will remain broken.

Wednesday, July 23, 2008

Can't Resist

No Big Hurry

My contention before I left was that this rally would be for real if the financials continued to rally. Sure enough this market rise has been substantial and led primarily by the financials. So long as the market continues to shake off the bad earnings news we go higher. I think 12K on the Dow is a likely target.

The shorts are getting worked. Meanwhile I'm quite comfortable in cash, thank you very much. I could be back to work Thursday, or not. Maybe not until Monday. I'm playing it by ear.

Thursday, July 17, 2008

Just Checking Up

More interesting was the performance of my picks from this morning (despite my purposeful lack of participation). Coal stocks got crushed. My picks were winners to the tune of about 9% each. Not bad for a day's work.

Apparently I'm morphing into some sort of stock picking mutant-wizard-demigod. Imagine that. Perhaps I'm becoming a space alien magician.

I am going to put on a clinic in the second half. You still don't think so? Just watch me.

Just for Fun

Short the coal stocks. All three of these coal names are sporting rather pretty head and shoulders tops. All three sitting right at the neckline.

Trying to Resist

I set my alarm this morning and rolled my ass out of bed with the intention of doing my homework before the open. Can't help myself. What if I want to get long some DNA or short some ORCL? My fear, I suppose, is that the rally will fail and I need to be ready...or something like that. Maybe it's that I'm excited to finally see all those green candles.

Looking at the futures up big confirms that I don't need to do much of anything. Couldn't be happier. Run baby run.

Wednesday, July 16, 2008

Cold Hard Cash

Vacation has officially begun.

I'm lovin' this action. Stocks are spiking all around and the shorts are getting buried. I can just imagine if I was still short I would be getting ground up into dust and returned to the earth today. Yeah fuck that. I'll keep my profits (most of them anyway), thank you very much.

Meanwhile this little bull orgy, should it continue, will set up copious opportunities upon my return. Just makes me feel all warm and fuzzy inside. Going away without my laptop will even be a good thing insofar as it will keep me from shorting into a rally that still has room to run. My best case scenario may just play out yet.

So unless I buy a small island in the Florida Keys and never return I'll be back on Wednesday, tanned a deep a shade of bronze, rested, recovered and relaxed. See you then.

Flat As a Pancake and Unofficially on Vacation

As long as the financials continue to rally this move up is to be respected. Hopefully the inevitable great selling opportunity will wait until I'm back to work.

So, guess that's it. As much as I want to call it a day and start my vacation, it's very difficult to walk away from the market. As long as the market doesn't straight up crash in the next four sessions I'll be cool. Odds are decidedly in my favor on that one but still, it makes me nervous to walk away. I watch so many situations waiting for just the right set-up. Wonder how many set-ups I will be missing. Could be some name I've been watching for two years waiting for just this one chance and once it happens it's gone.

Poor me. I have to go on vacation. And I need it. The last couple weeks have been tough for me. Haven't felt motivated or hungry but uninspired and distracted. Yet the trading account is up almost five percent this month after smashing the cover off the ball last month. So why be greedy?

Upon my return there will be a new account for me to grow and profit from. The opportunities will still exist. Better yet I'll be fresh and refocused.

Tuesday, July 15, 2008

Yet Hope Springs Eternal

My fat gains of this morning have thus melted away. I have taken down risk again in hopes that this bounce can last. Regardless of how much I'm in love with my latest round of short sales I will cover that shit on the drop of a hat and profits will be protected. Period. My gains have been made for this month; targets have been hit. Vacation is near. Why fuck it up?

A handful of shorts remain on my book, all profitable positions. Wort case: they get covered for modest gains. Winners will not be allowed to turn into losers. Besides we may not be done with the downside. If we start knifing lower once again I'll be back on offense. Until then I sit (rooting for these weak ass bulls).

Monday, July 14, 2008

So Much For Wishful Thinking

Rally got sold. So much for my wishful thinking/best case scenario. As long as stocks keep falling I'll keep shorting them. Line in the sand is 1425 on the S&P, we've bounced off it twice now.

Hmmm. I wonder if all of these bailouts are starting to lose their shine. Ominous indeed. Paulson and Bernanke are trapped and the market is starting to sense it. Gold will continue to work here.

I'd keep your crash helmet on just in case. And how far are we really from a series of bank runs? Interesting times we live in.

Best Case Scenario

Clearly this Fannie/Freddie bailout is an unmitigated disaster and throwing billions of dollars into these black holes is a great way to make the billions disappear.

Here is what I'm hoping for: a big frickin' rally, all this week and into next. See, I leave for vacation later this week and won't be back until Tuesday of next week. My intention was to get small and not have to worry about the market gyrations while I'm sitting in the Florida Keys drinking fruity cocktails. Besides looking at literally hundreds of charts this weekend it's obvious to me that we need a good rally to create opportunity.

I won't be buying stocks. Not looking to play this thing from the long side, aside from my gold position and maybe adding some energy names. With any luck I can get even smaller (having already done so thanks to Friday's afternoon rumors) this week without much damage and just put it on cruise control until the middle of next week. With any luck I'll be in vacation mode by this afternoon, provided this rally has some legs. Let's hope...

Friday, July 11, 2008

Not This Time Ben

The Fed will now open the discount window to Fannie and Freddie? Wow. This man is fucking batshit insane. Plan for higher interest rates and much higher gold prices. Shit at this rate it won't be long before it will be cheaper to wipe your ass with dollar bills than with toilet paper.

You might think a gold bull like myself would enjoy these sorts of things. You'd be wrong. See I have a son and I don't especially care for Bernanke trying to bankrupt his generation before he can even form a complete sentence.

The silver lining is that this bullshit went down on a Friday. I needed to take down some risk anyway. It's better than walking into a buzzsaw on a Monday morning. So I say fuck you Bernanke! I will keep all of my profits today. Hell with it, I'm calling it a day. A sad one for America indeed.

I'm pretty fired up. You can expect that I will rain down fire on this market next week, then I'll go on vacation. I'm especially pist for having covered LEH into the pop.

Have a nice weekend comrades.

Q & A

A: Your pension fund.

Oops. You're fucked.

NOTE: Your money market fund owns them too. As a matter of fact they're everywhere.

One Day Closer to the Next Bailout

What a nice day it is; the sun is out, the birds are chirping and the US financial system is crashing down around us. How pleasant.

Fannie and Freddie are inevitably zeros and wouldn't you know it- gold is going nuts. I believe I called that shit. Again.

Seriously, I've been talking about the likelihood of bloodbath for years and I can honestly say I've never seen the financial system so close to complete and utter collapse. Be afraid, be very afraid. And don't think we can't crash.

When the next big bailout comes I'm guessing gold goes nuts as the dollar craters and interest rates go higher. My question is this: once the government acts to bailout all those who have acted irresponsibly who is going to bail out the government? Hmmm. No one. This is truly too big to bail. Bernanke is just going to print money out of thin air and monetize all that bad debt. Which brings us back to why you must own gold.

Thus far I'm up about 3% on the day. I covered a few shorts this morning and bought more SLV at the open. You must own precious metals as a hedge against the crazy shit Bernanke is going to pull. Consider it an insurance policy. When your dollar no longer buys you so much as gumball you'll be able to trade your gold for a goat.

Thursday, July 10, 2008

America Continues to Hit New Lows

Congress has just eviscerated the fourth amendent. Just gives you that warm fuzzy feeling doesn't it?

NOTE: I will soon be writing this from some other fucking country.

Another Day, Another "Bottom"

DELL is a good example of this moronic notion.

Just for fun I shorted some LEH. Either I get stopped out @ $20 or it goes to zero (or whatever price the Fed bails it out at- say $10).

All Is Again Right With the World

What do you know? Profits are accruing to me in short order.

To pair with all my short exposure I continue to increase my metals exposure. My current disposition is long gold, short everything else. Not unlike my previous disposition which had been long energy, short everything else.

Making money on the short side still seems almost too easy and that makes me nervous.

Oh and I'm long AEM. Which is nice. Buy the miners here. Like GG too.

Wednesday, July 9, 2008

Random Thoughts

Two. If Iran were to wipe Israel of the map I really wouldn't care. A few less lobbyists in Washington.

Fun to Watch

Once I checked the market at about 3:30 it was full on damage control mode. Already small, now my exposure is almost nonexistent. I shoot first and ask questions later. I'm keen to the possibility of a big bounce although my hunch is that we have more downside first. It's one of those extremely rare instances where I would rather just sit on my hands and watch. I'm sure as hell not going to be buying much of anything.

Now today the bulls are getting killed again. Dow down 155 at the moment. Did you buy the latest in a series of bottoms called almost daily by CNBC? How's that working out for you? Keep in mind that every one of those yahoos telling you to buy is getting killed in this market. Just like your 401K.

At this point my next great trade may not be from the short side after all. Maybe it will be getting long more gold. I haven't taken much action but I'm starting to like how the metals are trading here. Also like the action in the mining stocks so I'm watching them closely.

Tuesday, July 8, 2008

Another Yawner

Frankly, boring is good. I remain net short but unconcerned with the market's strength. I welcome it. I'd much rather sell into strength. Gold made me a bit nervous mid morning and I almost got stopped out of my trading position. Thankfully I hung on as it has bounced again this afternoon. Commodities generally have downside still. Not looking to chase that trade having already taken advantage.

With the "hawkish" ECB signalling neutrality gold has upside. I put the word hawkish in quotations as there is no such thing as a hawkish central bank on the planet today (to my knowledge anyway). And Bernanke is a fucking joke. The Fed could give two shits about inflation. The consensus is that they are done cutting but I disagree. Under no circumstances will they raise and if anything they will cut again.

Monday, July 7, 2008

Whipsaw

Same for my account balance. Down big, then up big, then pretty much right back where it started. A waste of my time. There were many opportunities to be taken advantage of today and I did a piss-poor job of capitalizing. Tomorrow is a new day.

The Iceberg Has Just Been Struck

For Whom the Bell TOLs

Didn't expect today's 100 pt. rally to last. That being said I wasn't really expecting a 200 pt. drop from the highs by lunchtime either. I did add to my short exposure before the drop but I remain somewhat underexposed. So it's a good day so far but not great.

Put a fork in it.

Back at it Again

Funny. I had this intense urge to clear out my GLD position (in the trading account) on Thursday afternoon. Needless to say, I managed to rationalize hanging on. What do you know, it's getting creamed this morning.

Market is strong out of the gates today but this feels more like a retest of the broken lows on the S&P as opposed to a sustainable bottom. I'm getting smacked around a bit but remain very conservatively positioned coming out of last week, with lots of dry powder. This strength is welcome. To a point.

Thursday, July 3, 2008

This and That

Most traders make the mistake of thinking only about their potential profits. However, I'm looking at risk. Should the market decide to really bounce ICE will be 10 points higher in the blink of an eye.

Today I have no interest in trading stocks. I've been laying on the couch watching Wimbledon instead. If I was interested I'd be selling LRCX. If I was a day trader I'd also have been selling LRCX like crazy @ 36. But I am neither interested, nor a day trader.

If At First You Don't Succeed...

Shorted TOL again this morning. I swear it hates me. I short it, it bounces, I cover. Rinse and repeat. Like marriage and McDonalds hamburgers, very unsatisfying.

Anyway, fuck that shit. Eventually it cracks. Mark my word. It will trade in the single digits before next summer.

Does anyone else find it difficult to initiate short sales into a gazillion point drop? Thought so. As for today's action, expect the bulls to put on a brave face buy into the feel good Fourth of July rally.

Quick Word of Warning

Tomorrow is a shortened session which is likely to be quite interesting. Employment report and the ECB announcement on the docket before a long holiday weekend.

The lows on the S&P were penetrated today. A whole bunch of momentum stocks were shellacked including, but not limited to, coal, steel, ag and oil. Allow me to reiterate that we are completely fucked. Period. Don't try to sell me some bullshit about a second half recovery or the Fed is gonna save us. Ain't gonna happen.

It is not too late to sell. If you've been in denial this whole time you better start to take action ASAP. Raise cash, get out of debt and start living within your means. What happens if you get fired from your job? Are you prepared, just in case?

The time will come where there will be nowhere to hide. The pain is not even close to being done and I'd argue it's just getting started. This entire country is in for one big wake up call. Or should I say margin call?

Wednesday, July 2, 2008

Just Chillin'

So I'll just chill out and watch in delight as the mo-mo crowd gets a swift kick to the balls via cratering coal and steel stocks. Ouch. That shit's gotta hurt.

Maybe I'll go for a jog, take a dip in the pool and then a nap. Napping is one discipline for which I have nearly unmatched aptitude. I'm a talented fellow indeed.

In the past I've had a hard time stepping back from the market, feeling as if I had to play every move. As I gain experience though I realize that all of my greatest gains are AHEAD of me. Besides it's best to step back some on the heels of a ridiculously profitable run.

Let's Review

BOBE was trading @ $27. It's now around $28 but in the interim traded as high as $34. Loss!

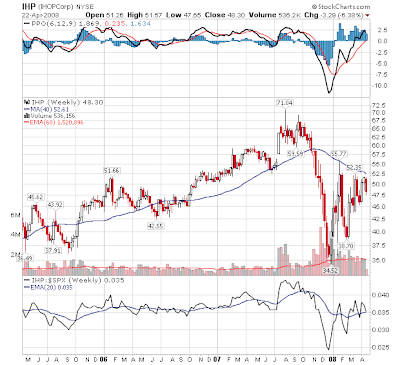

DIN (formerly known as I-HoP) was trading @ $48. Now $36. Big Win!

Finally we have my old friend CBRL. Told you to sell @ $34. Now $22. They just warned the other day. Big Win.

So I was 2 and 1. In the winners I was right to the tune of 12 points each. My thesis that higher oil prices would hit these roadside diners was correct I'd say.

Class dismissed.

The Plan For Today

Hopefully the market can trade higher (although I remain somewhat skeptical). My exposure is very limited having taken profits yesterday. Made myself some walking around money this morning selling the SII purchased at yesterday's close up $2.50 first thing.

Tuesday, July 1, 2008

A Sustained Bounce?

I continue to hope for a bounce in order to alleviate the oversold condition. I'd settle for a two or three day rally. That would be super.

This Market is Nuts

Maybe this is setting up for a bounce but I feel generally like these broad, seemingly schizophrenic gyrations back and forth are representative of a market under extreme pressure. A bounce higher would be great. I have a lot of dry powder and would love to reposition at higher prices. Any sustained rally would be a gift to the bears and another opportunity to sell. Just keep in mind the chances of an outright crash are currently elevated (yet remain as always very low).

I'm Just Sayin'

Covered...

New Highs, New Lows

Only real complaint I have is getting shaken out of my RDC long. I think it still probably goes higher, but not today. Problem is the position was chunky and my number one priority is to control risk regardless of my personal affection for any one position. So rather than just sit there getting rolled on I will live to fight another day. Not like I can't buy it back.

Energy names still get the benefit of the doubt as far as I'm concerned but at some point they will become a source of funds for moronic money managers looking to raise cash any way possible. Can you imagine if the the only place to hide becomes a bloodbath? That shit will be ug-ly. Just something to think about. Better hide the kitchen knives just in case.

Also...

I will wait and if given the opportunity re-load at a lower level.

New Position

Monday, June 30, 2008

Close the Book on the First Half of 2008

I'm just now hitting my stride and have a multitude of wins planned for the second half. Despite a merely average performance in the first half I am paying my bills and keeping the lights on. Those of you who continue to doubt me can go fuck yourselves.

As the market continues to hit new lows in the second half I will be hitting new highs. Count on it.

UPDATE: On the basis of gross profit June 2008 has been the best month I've ever had. I will dominate in the second half.

Friday, June 27, 2008

Got Me A Jump On Next Week

Added to an existing long position in RDC. Monday is the final day of the second quarter and I anticipate more upside in energy names. Regardless, the chart is just a thing of beauty. Who knows whether or not the breakout comes next week, but it's just a matter of time.

Trouble Ahead, Trouble Behind

Just when the pain becomes unbearable we will bounce. Things might not be so bad. Sell that bounce because we are nowhere near a bottom. This all has the potential to be very bad and it's not too late to protect yourself. Sell something and watch it go down. We have not yet seen fear but the fear will come. Oh yes, fear will come.

By then I'll be trading from a remote location high in the mountains. I'll have a food plot and shit. Off the grid with potable water. I'll corner the uranium market just for fun. Get a couple hundred head of cattle and some tricked out grain silos. My strategic petroleum reserve will be stacked thereby granting my private army military dominance.

I hope you have a plan amigo.

Thursday, June 26, 2008

Closing Bell

I will now redirect my attention to the important matter of the NBA Draft. It looks as though my team, the Chicago Bulls, will be taking this chump-ass point guard Derrick Rose. I, for one, am looking forward to trading Kirk Hinrich. Two birds with one stone. It's a good day.

Time to go pre-game. I know it was a tough day, try to keep yourself from jumping out your office window.

What Did I Say?

Apparently it was "sooner". The absolute panic low set in January on the DOW has been convincingly violated. Obviously dip-buying is no longer a viable strategy. Instead you want to sell rallies.

I am less than optimally positioned for this move having gotten smaller ahead of the Fed. Although I did put on a big fat IWM short position yesterday afternoon. I added some SRS this morning in addition to a few shorts. I'm not getting too aggressive in chasing anything here. We are in a bear market and that's not going to change anytime soon. There will be plenty of time to take advantage of the incredible pain that lies directly ahead.

From the long side I see very little to get excited about. The metals are the exception. Gold and silver are extremely close to breaking out and de-balling the shorts. I am cautiously adding more GLD in anticipation of the breakout and when it happens I'll be buying with both hands.

Wednesday, June 25, 2008

More Bailouts and Handouts

"A massive foreclosure rescue bill cleared a key Senate test Tuesday by an overwhelming margin, with Democrats and Republicans both eager to claim election-year credit for helping hard-pressed homeowners.

The mortgage aid plan would let the Federal Housing Administration back $300 billion in new, cheaper home loans for an estimated 400,000 distressed borrowers who otherwise would be considered too financially risky to qualify for government-insured, fixed-rate loans."

Tuesday, June 24, 2008

Nice Day For A Rally

We have been awfully close to the lows too and it's end of the quarter. Just something to think about.

I have taken down a lot of risk, into this morning's weakness, and built a war chest of epic proportions. Give me higher prices!

We shall see. The market remains uncomfortably close to the edge of a cliff. Sooner or later it goes over.

Just Nibbling, For Now

Just For the Record

I CALLED IT.

Disclaimer: In "real life" I am not an outwardly arrogant person but for the purposes of this blog...

Better Late...

The Associated Press actually had a headline over the weekend that read "Everything Seemingly Spinning Out of Control". Isn't that the truth. We have natural disasters, raging inflation, two seemingly endless wars, a housing crash, a stock market that is circling the bowl and an oil crisis. That's the tip of the iceberg. Don't forget global warming. It's uncanny that at the very moment in our nation's history, and world history for that matter, that we need real forward-looking leadership we have the worst presidential leadership in my lifetime (maybe ever). To be fair it's not just Bush and Co. but the entire structure that is rotten (both parties share responsibility). Not only are we not working towards solutions to any of these problems but we are working to exacerbate them.

I am legitimately frightened for my family going forward. In the meantime I am raping and pillaging this market. Up 10%+ for the month of June after poor performances in both March and April. The second half of last year represented the best six months of my trading career and I seek to replicate it this year.

Not much has been posted here of late. Hopefully I can get back in the groove. Things are only going to get more interesting.

Saturday, June 7, 2008

Wednesday, June 4, 2008

Friday, May 9, 2008

Dow 13K, S&P 1400...

I could give you the case for both though I've been expecting the latter. From a technical perspective it looks like: breakout, retrace and possibly set to move higher. However from a fundamental perspective I maintain that we are more fucked as ever.

Interesting divergences developing here. There are many good trades to be had both long and short. Financials and retailers especially are starting to look weak. From the long side anything commodity related is en fuego and there are many attractive breakouts to be had.

For the time being I'm more or less market neutral (slightly long). Looking to play both sides and not stick my neck out too far. I would strongly advise caution here. Playing the commodity explosion from the long side yet increasing position sizes on some of my favorite shorts.

Just a quick note on gold. The yellow metal has drawn itself a head and shoulders top which may or may not result in lower prices. I've been nibbling. Not as much on gold itself but the miners are looking firm and silver is very attractive around these levels. I can tell you this, if gold can dig in here and remain firm I will be a buyer with both hands. The case for owning metals has never been stronger.

Thursday, May 1, 2008

Trigger Finger Getting Itchy

The bears are not out of the woods yet. We have the employment report on Friday. I won't be looking to get real aggressive ahead of that.

Tuesday, April 29, 2008

Waiting for the Fed

Portfolio remains market neutral with a slight long side bias seeing as few shorts have been working.

Not much to do before Wednesday's announcement. Sitting on my hands. There are a handful of breakouts in play but it's not time to get all excited, about anything.

Wednesday, April 23, 2008

High Gas Prices = Less Disposable Income

Can anyone tell me who the hell eats at Bob Evans? Old people after Sunday services? I've often wondered how they stay in business when I never see any cars in their parking lot.

Can anyone tell me who the hell eats at Bob Evans? Old people after Sunday services? I've often wondered how they stay in business when I never see any cars in their parking lot.As for Cracker Barrel and I-Hop, they are roadside eateries. Think summer trip. Something tells me that after dad stops and fills up the minivan at $3.50+/gallon he's not going to want to stop again.

I admit to having a special affection for Cracker Barrel. Think sour dough french toast. That being said, I bet all three of these stocks are going to trade much lower. Haven't taken any action in these names yet as I remain cautious in initiating new short sales but I will be looking for an opportunity in the near future.

Monday, April 21, 2008

Back in the Saddle

Bulls remain in control, for now. Outright delusion is widespread amongst market participants. Seems unlikely to last very long. At some point soon the financials will lead us lower again. Also sniffing for short side opportunities in commercial real estate as those stocks have seen big runs based on the fairy tale that everything is going to be just fine. I continue to believe otherwise.

Saturday, April 19, 2008

Triumphant Return

I return somewhat richer than when I left. Click-here to review my call on NFX. Now the results:

That's almost 14% this week alone. Your welcome. Now you too can afford to go on vacation.

That's almost 14% this week alone. Your welcome. Now you too can afford to go on vacation.

Enough bravado. Perched in my mountain hideaway I paid very little (relatively speaking) attention to the markets. Now that I'm back and feeling refreshed I'll be getting down to business. Obviously the bulls are in charge and the market has broken out to the upside. I'd not be surprised to see 13K on the DOW in short order. I'll give the bulls a head start before I begin hunting them down and slaughtering them again.

Friday, April 11, 2008

Vacation

Tuesday, April 8, 2008

I Love Me Some Volcker

``What appears to be in substance a direct transfer of mortgage and mortgage-backed securities of questionable pedigree from an investment bank to the Federal Reserve seems to test the time-honored central bank mantra in time of crisis: lend freely at high rates against good collateral; test it to the point of no return,'' he said.

Volcker said the modern financial system has ``failed the test'' of the marketplace. When asked whether he predicts a ``dollar crisis,'' he said, ``you don't have to predict it, you're in it.''

Monday, April 7, 2008

Sunday, April 6, 2008

Welcome to the New and Improved Socialist America

The Fed chose to backstop the sale of Bear with 29 billion dollars of taxpayer money without which the transaction would never have taken place. The justification for doing so, according to Bernanke, is that had Bear been allowed to fail it would have triggered financial armageddon. There is probably some truth in that explanation but the end in this case certainly does not justify the means.

The action Bernanke and Paulson took is definitely unconstitutional and probably illegal. So you'd figure that when they appear before Congress to answer questions regarding this unprecedented transaction that perhaps our representatives might have some pointed questions. You'd figure wrong. The congressional hearings were a circle jerk. I heard more praise of the bailout then criticism. It saved the market from going down so it had to be done. Coincidentally, almost every one of the questioners have taken large campaign contributions from Wall Street.

I want to vomit. I had to turn the TV off. You mean to tell me that after having acted prudently throughout the housing bubble (20% down on a house I could afford, fixed mortgage, sold at the top) that now I have to help bailout those that acted imprudently? Are you fucking kidding me? I could have bought three or four houses, taken out ARMs with zero down and generally just speculated recklessly like many of those around me, but no, I did not. Now when the shit hits the fan I should have to bail out the risk takers with my tax dollars?

We now have, in this country, privatized profit and socialized risk.

The thing with Bear is that they fucked up and should have to face the consequences just like the individuals who speculated and got it wrong. But no, these guys award themselves billions in bonuses and now expect to be bailed out. Filing bankruptcy would have insured the return of those bonuses that were looted from the company but thanks to our Fed and Treasury there are no consequences for failure.

Did you not see the CEO of Bear on CNBS just days before they blew up? According to him everything was just fine, no cause for alarm. Three days later they are on the verge of bankruptcy? Where are the handcuffs? What am I missing? You see it's illegal for executives to make false statements to the market. Where are the cops?

Furthermore this whole scam is an exercise in obfuscation. Even though the taxpayer is on the hook for the losses we are not allowed to see just what Bear has on the books. The whole idea is to avoid taking realistic marks on the toxic waste that is everywhere.

So without objection from Congress we have now institutionalized the taxpayer bailout of any financial concern dubbed too big to fail. There will be many more of them and I suppose the Fed is going to take all of their bad paper onto it's balance sheet? We are now the United States of Subprime. The Fed keeps going at this rate and I'm going to have to turn my walk-in closet into a vault to hold all the gold I'm going to have to buy as protection against the complete debasement of our currency, our values and our society in general.

This bailout was a watershed moment. We have entered a new era in which anything goes. I could not possibly be more ashamed of my country.

Wednesday, April 2, 2008

Drunken Bulls Run Amok

So it appears to be a double bottom on the indexes. The bullish contingent is all lathered up and breathing heavy. It's the bottom! I say maybe for now. The DOW needs at least another hundred points for confirmation of a true double bottom.

We should expect more of these violent whipsaws going forward. No question, bear markets are difficult to trade. I feel confident though that we have not seen the lows for the year.

As for my personal trading, it's fair to say it's been bumpy this year. Yesterday I was under attack again but worked early in the day to limit exposure to the short side. I consider yesterday a success insofar as it could have been much worse than it was. I just need to stay in the game. I banked a lot of coin off of the declines we've seen thus far and I can envision a much greater opportunity not too far down the road.

Monday, March 31, 2008

Here We Go Again

Looking at the futures early this morning it looks like a flat open which is nice considering the headlines over the weekend. The Fed apparently will be granted new powers to regulate, pending congressional approval. Makes me want to vomit. The Fed needs to be stripped of it's power not given more. To me this news smells like a regulation shell game. There is absolutely no genuine intention by this administration to regulate anything especially financial concerns.

The whole idea to give the Fed more power reeks of an Orwellian air and scares the shit out of me. We are well on our way to becoming the Socialist States of America.

As for the market, I still think we consolidate some more before ultimately heading lower. Commodities are correcting here and I intend to wait before viewing it as a buying opportunity. Once I see some stability I will be a buyer of gold and agricultural commodities. Somewhat agnostic on oil though- the supply/demand picture is favorable but I expect demand destruction as a result of the recession.

Keeping an eye on technology as I think the sector will offer some nice shorting opportunities in the near future. The idea that investors can hide out in technology names as we enter a recession is pure fallacy.